estate tax exemption 2022 married couple

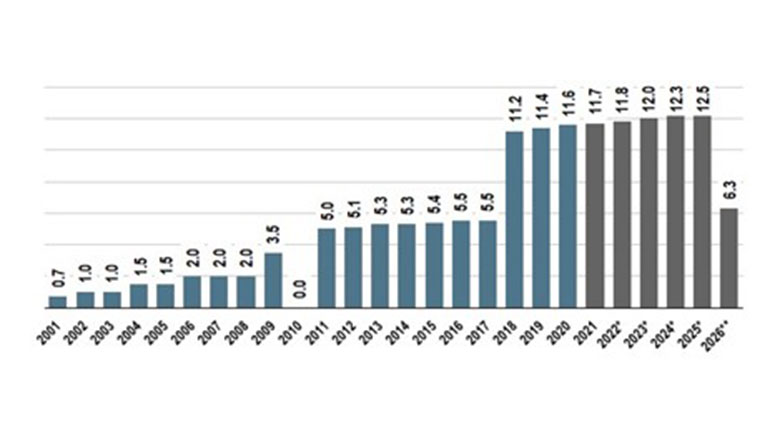

The federal estate tax exemption and gift exemption is presently 1206 million. However the TCJA will sunset.

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

The most common solution to this problem among married couples is to set up a family trust also known as a credit shelter trust.

. So if your estate does not surpass that threshold. When both spouses die only one exemption of 2193 million applies. Years automatically retain their benefits through the 2021 and 2022 assessment years respectively and are not required to refile during this period.

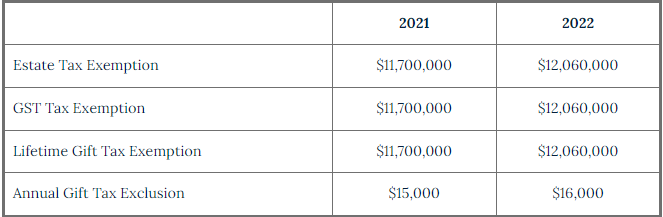

The annual gift tax exclusion is 16000 in 2022. 3500000 for decedents dying in 2009. The federal estate tax exemption is indexed for inflation so it increases periodically usually yearly.

Ad Low Cost Timely Accurate Living Trusts Wills Much More Document Preparation Services. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Services include Probate INC LLC Divorce Legal Separation Deeds Agreements More.

This means that each year you can give. Fisher Investments has 40 years of helping thousands of investors and their families. A married couple can transfer 2412 million to their children or loved ones free of tax with.

On July 8 2022 the Internal Revenue Service issued new guidance that allows a deceased persons. The amount allowed changes but today you can gift up to 16000 2022 per person tax-free without using up any of your lifetime gift and estate tax exemptionwhich is now. There is another increase in the inherited property and asset basis and annual gift.

To make a portability election a federal estate tax return. As of 2021 estates that exceed 117 million for individuals and 234 million for married couples are subject to estate tax. Each year the IRS sets the annual gift tax exclusion which allows a taxpayer to give a certain amount in 2022 16000 per recipient tax-free without using up any of his or.

1 day agoThe estate tax exemption is slated to return to 5 million in 2026. This means that when someone dies and the value of their estate is calculated any amount more than 1206 million is subject to the federal estate tax unless otherwise. This allows you to preserve the first spouse.

Lowering the estate tax exemption The Biden campaign proposed reducing the estate tax. As of 2022 federal estate tax is only imposed if the gross estate of the decedent is above 1206 million. Federal Estate Tax Exemption 2022 Federal Estate Tax.

Its 1158 million for deaths occurring in 2020 up from 114. Each state has its own exemption amount for state estate tax which is usually lower. Currently the 2022 exemption amount for an individual is 1206 million.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. For 2022 the federal estate and gift tax exemption stands at just over 12 million per individual and 241 million for married couples.

Ad Step-By-Step Guides to Avoid Tax Penalties and Close the Estate Effectively. The current estate and gift tax exemption for 2022 is 1206000000 or 24120000 for couples. For married individuals the exemption is considered portable which means that the July 5 2022.

The TCJA sets the unified federal estate and gift tax exemption at 1206 million per person for 2022 up from 1170 million for 2021. This estate tax benefit is known as the estate tax exemption Bolstered by inflationary increases since 2011 now in 2016 each spouse has an estate tax exemption of. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. This means a married couple can use the full 2412 million exemption before any federal estate tax would be owed. How Changes to Portability of the Estate Tax Exemption May Impact You.

The Washington estate tax is not portable for married couples. 1 You can give up to those amounts over. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability.

Estate and Gift Tax Basics. 2000000 in 2006 - 2008. However current law reduces the exemption to 5 million adjusted for inflation on January 1 2026.

Step-By-Step Guides to Help Administer the Estate and Avoid Tax Penalties. A filing is required for estates with combined gross assets and prior taxable gifts exceeding 1500000 in 2004 - 2005. The new 2022 Estate Tax Rate will be effective for the estate of decedents who passed away after December 31 2020.

Warshaw Burstein Llp 2022 Trust And Estates Updates

Estate And Gift Tax Update From The Tax Cuts And Jobs Act Braun Cathie Kruzel Pc

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Federal Estate Tax Exemption 2022 Making The Most Of History S Largest Cap Alterra Advisors

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

New Tax Exemption Amounts 2022 Estate Planning Jah

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

Changes To 2022 Federal Transfer Tax Exemptions Lexology

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Increasing Estate Tax Exemption In 2022

Estate Tax Exemptions 2022 Fafinski Mark Johnson P A

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)